These assemblies are governed by the announcement of the EOS network of its rebranding in Vault; With this strategic turn, the project focuses on location as a key player in Web3 banks.

The EOS network is renamed Vault; The course flies by 26 %

In a statement published this Tuesday, March 18, the EOS network announced its rebranding, now called Vault, and its turnover point to the Web3 Banks sector.

According to the company, the official EOS transition to Vault is scheduled for the end of May 2025. EOS holders will have access to the exchange portal to replace their chips to a 1: 1 ratio.

Vault will also retain the EOS infrastructure, integrate with EXS, bitcoin digital banks, and will cooperate with CEFF, Spirit Blockchain and Blockchain Insurance Inc. to offer improved financial services.

The enthusiasm around this rebranding led to an increase in demand for the native EOS network. Its value has increased by 26 % over the last 24 hours, and Altcoin is currently classifying as the most effective assets on the market.

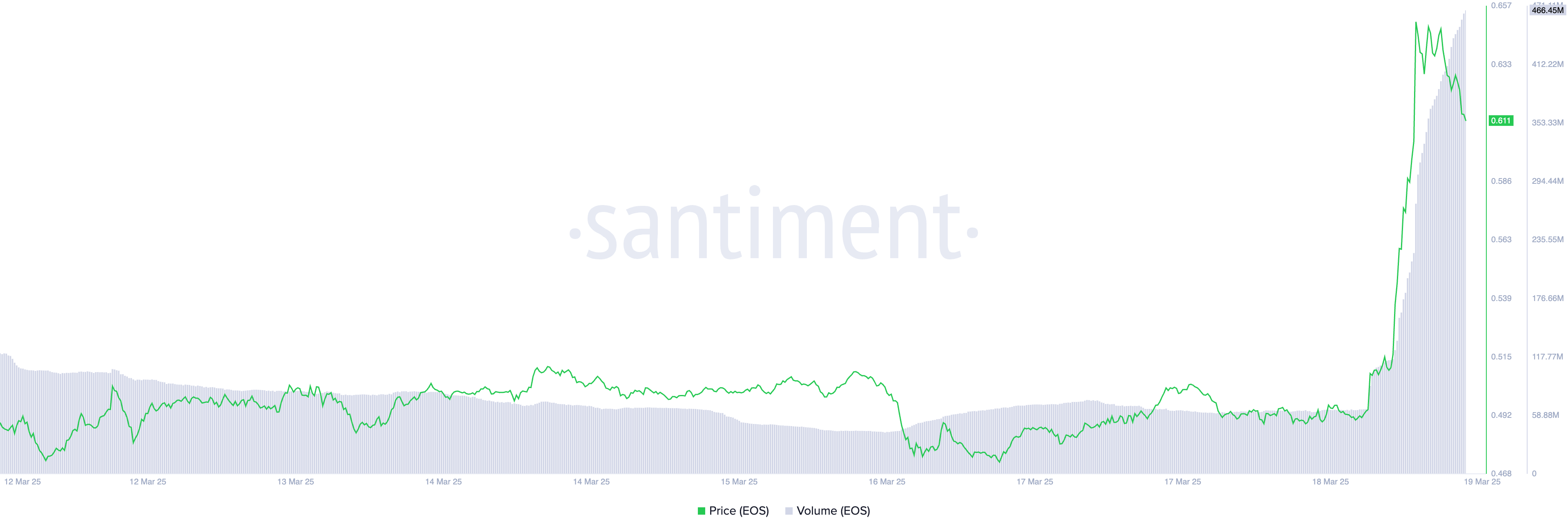

The enthusiasm of investors is obvious, reflecting in the volume of daily EO transactions in a sharp rise. This shows that the course jump is supported by real market demand. At the time of writing this article, this volume is $ 466 million, which is 631 % in the last 24 hours.

When the price of the asset and its volume of transactions rises in this way, it indicates a high market activity powered by high purchase pressure. This combination signals bull momentum on EOS money markets, indicating increased demand for this asset and course assessment.

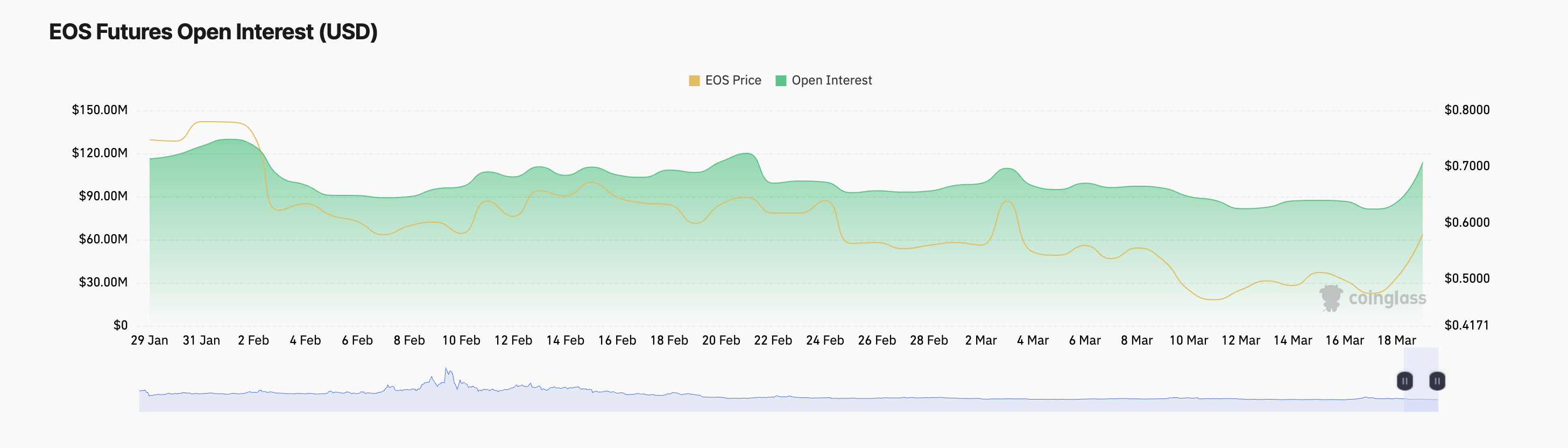

The open interest (OI) EOS also climbed, signaling increased confidence in traders and increased activity around Altcoin. At the time of writing this article, OI is $ 113 million, which has an increase of 33 %in the last 24 hours.

We remind you that open interest (OI) corresponds to the total number of ongoing derivative contracts such as term contracts or options that have not been resolved. When the OC of the assets rises, it indicates the increased participation of traders and capital flows. This is therefore a sign of reinforced market beliefs towards the EOS project and suggests the likelihood of a permanent assembly of the course.

The course faces a major test

At the time of writing, the EOS is negotiated to $ 0.60 and transformed the resistance level of $ 0.56 into a support floor. If this level is maintained, it could help drive the price of Altcoin around $ 0.70, which is the summit it last achieved in early February.

On the other hand, a negative change in traders would cancel this bull projection. If sales are increasing, investors achieve their profits, altcoin could lose its new profits and relapses to re -test $ 0.56 support.

If this level does not hold, EOS could fall on its cavity of the year, which is located at $ 0.43.

Morality of History: Sometimes the crypto of happiness is as many bitcoins as possible.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.