This trend reflects the growing acceptance of bitcoins as a strategic ratio of reserve and coverage against inflation.

Why do public enterprises accept bitcoins in 2025?

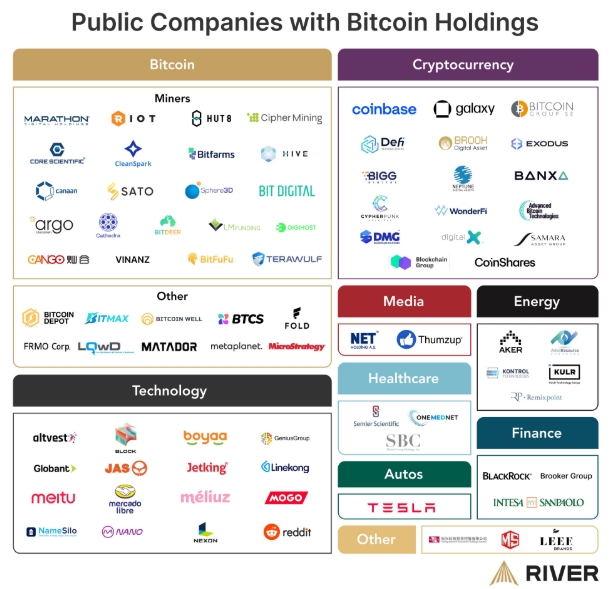

Digital Asset Bokerage Company River revealed that 80 public companies have bitcoins compared to only 33 two years ago.

“80 public companies are now buying bitcoins. It was 33 companies two years ago. In two years they will be …” he wrote the river and left the end of his waiting post.

This list of companies that accept bitcoins covers several industries with a high concentration in technology and finance. The technology sector represents half of public companies with bitcoins. Data Bitcoin Treasuries show that companies like Microsthegs (now strategies), Tesla and Block are at the forefront of bitcoin integration into their financial strategies.

Financial institutions account for 30 % of the total number of List and Fold Holdings and Coinbase Global, which have an indirect BTC exposure through ETF (stock exchange funds). Crypto mining industry represents 15 %, mining giants such as digital marathon and restless platforms with considerable bitcoin reserves.

The remaining 5 % include companies from other sectors, including retail and energy. These companies try Bitcoins for transactions and diversification of their evaluation.

Several key factors motivate the acceptance of bitcoins among public companies. Coverage against inflation has become a major aspect, many companies looking for alternatives to traditional assets.

“Bitcoin is a currency of freedom, coverage against inflation for middle -class Americans, remedy against the degradation of the dollar as a currency of global reserves and outputs from a devastating state debt. Bitcoin will not have a stronger defender than Howard Lutnik,” said US Secretary for Health and Social Services Robert F. Kennedy Jr.

Many companies also accepted bitcoins as a monetary reserve strategy and bet on their long -term recognition. In this respect, companies show the way as strategies.

In addition, investors’ pressure has played an important role, while institutional investors and shareholders are increasingly pushing the company to diversify digital assets. In some regions, the regulatory clarity and policy of Pro-Krypto still supported the acceptance of these assets.

Cumulative Bitcoin Assets continue to rise

In parallel public companies accumulate bitcoins at an unprecedented rate. Between 2020 and 2023 they held around 200 000 BTC. In 2024 alone, 257,095 other BTCs were obtained, which doubled a total of five years ago.

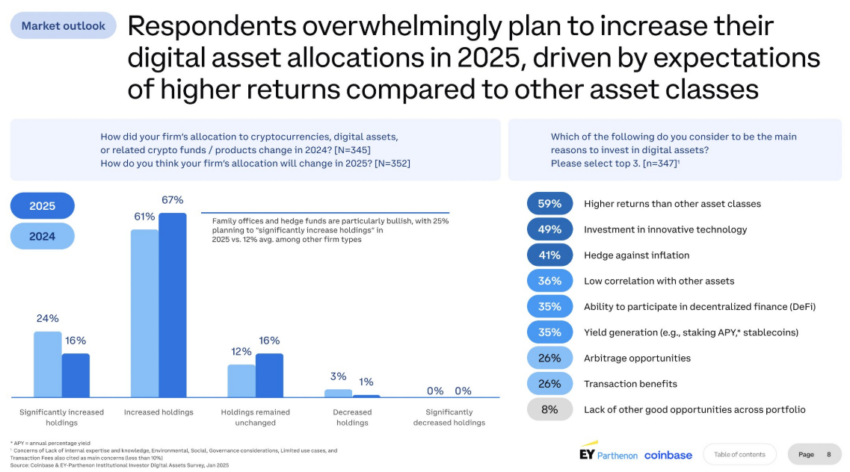

In the first quarter of 2025, approximately 50,000 to 70,000 BTC have already been added to the assets of these companies. It is interesting to note that Microstrategy and Fold Holdings are at the forefront of these acquisitions. A recent survey of Coinbase institutional investors also said that 83 % of institutions plan to increase their contribution to the Krypto 2025 assets.

The increase in the acceptance of bitcoins by public enterprises also coincides with the new wave of exchange on the basis of a crypt ( initial public offer). Well -famous companies including Gemini and Kraken, predict IPO, emphasizing greater institutional confidence in digital assets. These IPOs provide new capital flows and further legitimize the entire crypto market.

Bitcoin also became a financial rescue buoy for difficulties in trouble with the effort to increase the course of its shares. In fact, some companies whose income is down have actually turned to investment in bitcoins to attract new investors and strengthen their market position. As a result, BTC plays an increasingly remarkable role in business strategies.

Despite the impressive growth of the acceptance of societies, according to the corners report, public cryptoping companies still represent only 5.8 % of the total capitalization of the crypt market. This suggests that there is still a considerable expansion range.

In addition to commercial cash, growing acceptance of bitcoins affects financial planning in other areas. For example, more and more American parents choose bitcoins as an alternative to traditional university savings plans and focus on its long -term growth potential to finance education expenditure.

So, while 80 public companies now have bitcoins, this trend shows no signs of slowing. If the current growth trajectory continues, institutional acceptance will deepen because more companies turn to bitcoins.

Morality of History: Those who ignore the bitcoin retreat to jump better.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.